philadelphia property tax rate 2022

The Inquirer analysis is based on 2023 assessment data pulled from the citys property assessment site Monday afternoon gathering about 581000 records. Get a property tax abatement.

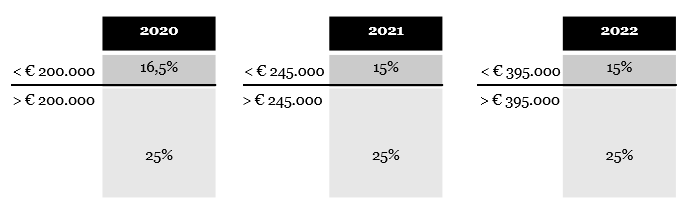

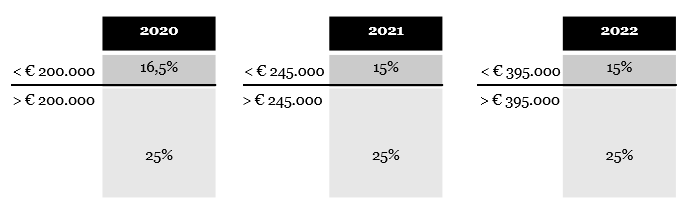

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights Greenberg Traurig Llp

Bills reflecting those assessments will be issued in December of 2021 for taxes due in March of 2022.

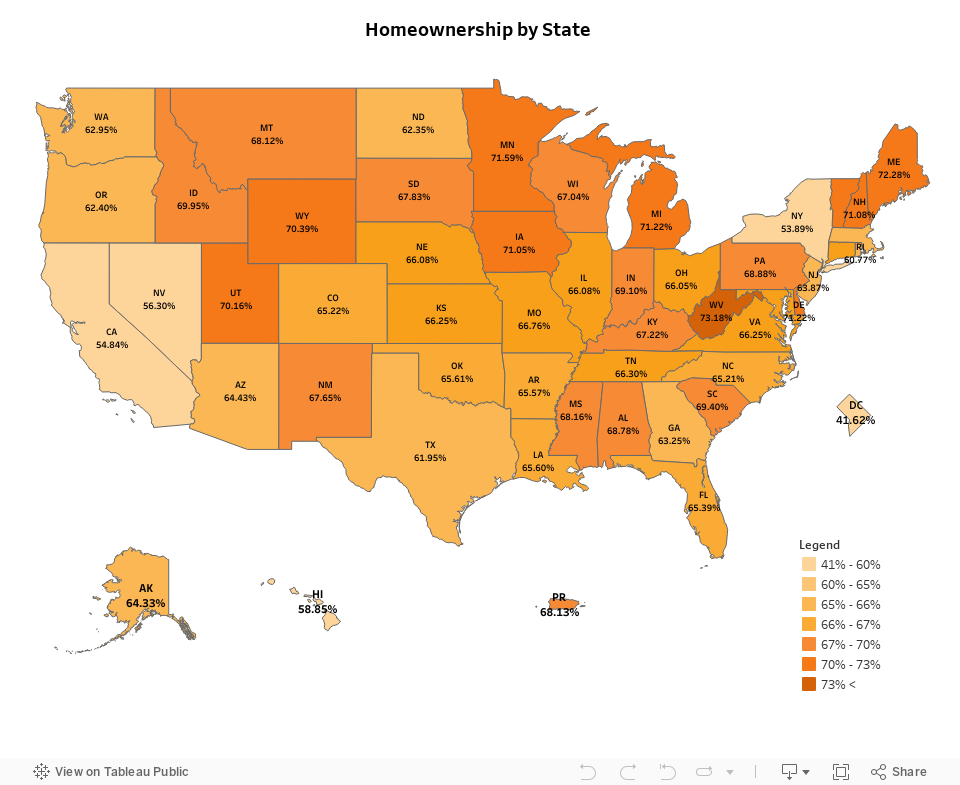

. The table above shows the fifty states and the District of Columbia ranked from highest to lowest by annual property taxes as a percentage of the. The state constitution allows abatements to encourage improvement of deteriorating property or areas 16 This is the basis of Philadelphias long-standing 10. In 2020 youll see that the land is valued at 30315 and the improvements at 171785.

Appraisal Fee 600. 2 days agoBetween 2022 and 2026 the city is projected to lose 572 million of non-resident wage tax revenue compared to what it would have collected had there been no Covid-19 pandemic according to the. For the 2022 tax year the rates are.

091 of home value. Philadelphia real estate has a median selling price of roughly 208000. Get Real Estate Tax relief.

Philadelphia County collects on average 091 of a propertys assessed fair market value as property tax. Loan Origination Underwriting Fees 4500. The real estate tax for tax year 2020 was 13998 ranking No.

Active Duty Tax Credit. Only property owners whose values change will receive notifications. 06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as assessed by the Office of Property Assessment OPA.

Tax Year 2022 assessments will be certified by OPA by March 31 2021. The citys property tax rate is 13998 of the assessed property value. If you disagree with your property assessment you can file an appeal with the Board of Revision of Taxes BRT.

Philadelphia property tax rate 2022 Friday March 18 2022 Edit. About the data. Look up your property tax balance.

Get the Homestead Exemption. Yearly median tax in Philadelphia County. Disabled Veterans Tax Exemption.

Mayor Jim Kenneys administration isnt reassessing all properties for tax years 2021 or 2022 instead giving the citys Office of Property Assessment time to implement a long-awaited new computer system make. Pennsylvania is ranked 1120th of the 3143 counties in the United States. By phone by calling 877 309-3710.

Thats slightly below the citys estimate of more than 582000 total records. Philadelphia property owners will not have their home values reassessed until 2022 with some exceptions. For city residents the wage tax would decrease from 384 to 37 under Kenneys proposal.

Home Inspection 500. Continue to use our balance search website to pay your Real Estate Tax until October 2022. The City and the School District of Philadelphia impose a tax on all real estate in the City pursuant to Philadelphia Code Chapter 19-1300 as authorized by 72 PS.

Enroll in the Real Estate Tax deferral program. Property tax bills are typically sent out in December and are due March 31 of each year Unsplash photoJacob Culp The Philadelphia Tribune. Paying your Philly property tax online is always best.

Title Insurance 3750. Her last day with the City of Philadelphia will be June 24 2022. Get Real Estate Tax relief.

Real Estate Tax Abatement. Antique Tennessee State Map 1888 Miniature Vintage Tiny Map Of Tennessee 9711 In 2022 Tennessee Map Tennessee State Map Miniature Map Financial Tax Consultant In 2022 Tax Consulting Equity Pin On United States. Currently the Philadelphia property tax rate is 13998 and the Homestead Exemption is 45000.

Tax bills will stay largely the same for most. Get a property tax abatement. The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200.

In response Mayor Jim Kenney is proposing a reduction in the citys oft-criticized wage tax. Get approval for work to a historic property. Philadelphia property owners are enjoying a two-year reprieve from reassessments and the tax hikes that often follow.

For the 2022 tax year the rates are. 1 shrinks the value of the 10-year abatement for new residential properties by 10 annually starting after the first year until. Property Taxes on a Philadelphia Home Without Abatement.

Buyer Closing Costs Philadelphia Home 750000 purchase price 20 down payment Pennsylvania Realty Transfer Tax 3750. 56 out of 67 states in Pennsylvania. Philadelphia Realty Transfer Tax 12293.

After that date this tax will be added to the Philadelphia Tax Center. Bills reflecting those assessments will be issued in December 2021 for taxes due in. The Office of Property Assessment OPA determines the value of.

Philadelphia homeowners who are 100 disabled as a result of military service are exempt from paying property taxes. May 03 2022 As Philly braces for property value reassessments Kenney proposes wage tax reduction and other relief The real estate boom has increased the aggregate value of residential properties. The fact is that there are single-family houses available in the 4000060000 range that can be rented out to single women with no kids who prefer privacy.

Philadelphia could see a short spike in construction in 2022 after a record number of developers applied for permits ahead of the citys expiring property tax abatement. These rates vary greatly based on the neighborhoods overall security and appeal. Owners will still have the right to appeal to the Board of Revision of Taxes and the opportunity.

Philadelphia City Planning Commission plan reviews. Get a civic design review. Report a change to lot lines for your property taxes.

Report a change to lot lines for your property taxes. Inaccurate or incomplete data could affect the results of the analysis. Real Estate Tax Rates due dates discounts and exemptions for the Citys Real Estate Tax which must be paid by owners of property in Philadelphia.

A bill that took effect Jan. Together they add up to 202100 which when multiplied by 13998 totals 2829 in property taxes due for the year for this particular home.

Iowa Reduces Corporate Individual Income Tax Rates Grant Thornton

Philly Property Reassessments Mayor Kenney Proposes Wage Tax Reductions Other Relief Efforts To Counter Spikes In Value Phillyvoice

Pennsylvania Property Tax Calculator Smartasset

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

Newmark Completes Largest Single Asset Multifamily Sale In Philadelphia S History In 2022 Center City History Real Estate

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Massachusetts Property Taxes These Communities Have The Highest Rates In 2022 Boston Business Journal

United States House Price Index Yoy April 2022 Data 1992 2021 Historical

The State Of Safety In Maryland 2022 Safewise

New 2020 2021 Federal Income Tax Brackets And Tax Rates Ageras

Handle With Care 2022 Property Tax Bills Department Of Revenue City Of Philadelphia

Digital Currency Was In Computer Industry For 20 Years Send2press Newswire Memory Module Computer Memory 20 Years

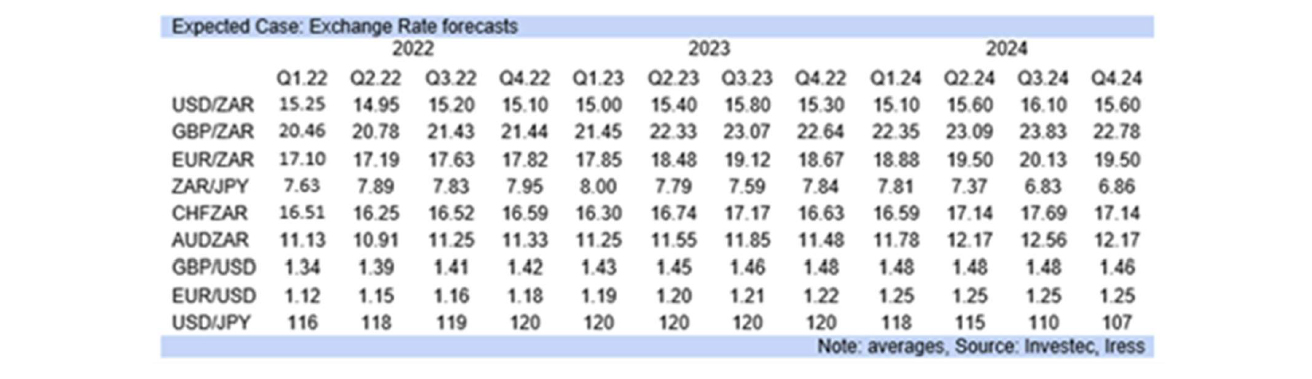

Rand Note Annabel Bishop Investec Chief Economist

What U S Cities Have The Highest Property Tax Rates Mansion Global

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Traditional Investments Vs Airbnb Investments Infographic Investing Rental Property Investment Real Estate Infographic

New 2020 2021 Federal Income Tax Brackets And Tax Rates Ageras